There’s long been this debate of whether ETH will ever flip (or take over) BTC’s market cap. Proponents of each will vehemently defend their positions, so here I am with my noob prediction that yes, over time, probably even pretty soon (within 2 years), we may see ETH overtaking BTC to become the #1 cryptocurrency in terms of market cap.

From my perspective, use-cases bring value, and currently (and even in the future), ETH is simply designed for unlimited use-cases, whereas BTC’s use-case has ever only been to be a good hard asset and store of value.

And that’s fine as it is. They are two very different animals that are often compared side by side simply because they are both born from the blockchain. But we’ll see they are as different as can be. It’s like comparing the market cap of Gold (USD10T) vs the market cap of the S&P 500 (USD$33T as of 31 Dec 2020).

Why ETH will flip BTC

As I mentioned, the why is in the use-cases. Think of the dominant narratives of BTC being Gold 2.0, and ETH being the platform upon which the new web will be built on.

- Smart Contracts

- NFTs

- DeFI

- Gaming

- ETH 2.0 – Switch from POW to POS (scalability)

- EIP 1559 (inflationary to deflationary currency)

Ethereum use-cases

Smart Contracts

The ability to create and execute smart contracts without a trusted 3rd party is the crux of what makes ETH, and blockchain applications so valuable. It means we can conduct peer to peer contracts without middlemen and without paying exorbitant fees to these middlemen.

This will upend so many industries while at the same time making them more error proof.

Some notable use-cases for smart contracts are voting systems with governments, healthcare records, real estate title deed ownership and much more.

NFTs (Non Fungible Tokens)

Many of you must have heard about how the Overly Attached Girlfriend meme sold for USD$700K (or 200ETH), and wondered “what the fuck??”.

Well, you’re not alone. But at the end of the day, what matters is verifiable authenticity and scarcity. So… if an original oil painting (that can be replicated such that the naked eye can’t tell the difference) can sell for millions, why not digital erm.. art?

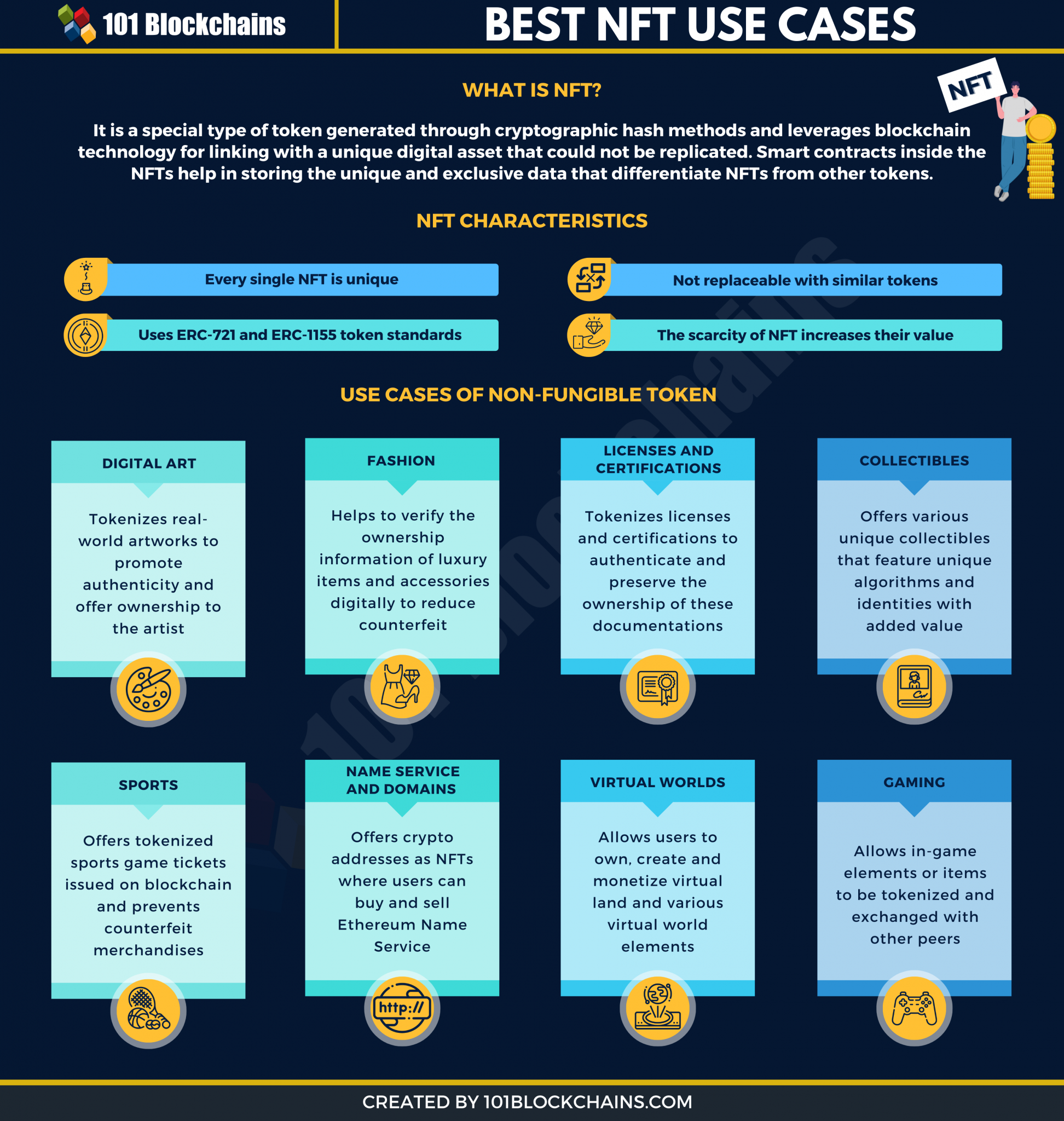

NFTs are not just limited to memes and art. In fact, it seems like almost anything (with perceived value) can be minted into an NFT. For example, Jack Dorsey’s first ever tweet, cryptokitties, key sporting moments and collectibles can all be minted into NFTs.

Below is a good explanation and exploration into the different use-cases of NFTs.

DeFI (De-centralised Finance)

Like smart contracts that allow you to execute pre-determined outcomes without an intermediary, DeFI, or decentralised finance, does that for banking and financial institutions.

You no longer have to trust a bank (we all know how trustworthy they are) to look out for the little fellas, and we can use DeFI to execute all our banking needs.

DeFI protocols like Aave, Uniswap and Compound are super popular, providing lending, borrowing and liquidity all without having to trust a 3rd party to manage it for you.

I am not at that level yet, but I am using blockchain companies like crypto.com to provide me with a better interest yield on my money (6.5% APR on Bitcoin), plus enjoy free netflix and spotify.

Gaming

Blockchain is changing gaming in a huge way. Remember NFTs? Well, it turns out, in-game items like swords and shields are NFTs, and the best part of blockchain interoperability is that now, you can bring those in game items you found or purchased in Game A, into Game B!

The look and feel of the items may change to match the UI and era of each game, but they are essentially the same items that you can port over into many different games. Buy a sword once, slay many different monsters in different games!

I’m not even a hardcore gamer and I’m excited about that!

Think about the possibilities of that. In order to defeat a boss level in Game A, you’ll first need to access Game B to retrieve a power ring, or something like that. This applies to even casual games like Bitcoin Hodler.

ETH 2.0 – Transition to proof of stake

From a technical perspective, ETH is currently in progress to transition from a proof of work protocol to a proof of stake protocol.

This will help scale ETH transactions eventually by hundreds of folds, and allow it to truly be the transactional layer of the new internet. This is a multi-year project, and there will be some risks involved. B

But if they can pull this off, ETH will definitely be a lot more valuable than it currently is.

The proof of stake protocol will also encourage people to hold their ETH and participate in staking to earn more ETH by validating transactions. With less of the currency in circulation, price goes up.

EIP 1559

EIP 1559 is another important update to the Ethereum network. It aims to reform the existing fee market to mitigate fee volatility, as well as to turn the ETH token itself into a deflationary currency by baking a token burn into each transaction.

The elimination of the volatility of fees will make for a much better user experience, and with fees a lot more predictable, and non-biddable, all the user has to decide, is to transact in this block, or not.

With the fee burn, ETH may become a deflationary currency, with diminishing supply over time, which always bodes well for price.

If you have an hour and 37 minutes to spare, here’s a video talking more about EIP 1559.

As you can see from above, ETH has a lot more use-cases over Bitcoin, and as it swallows up more industries and unlocks more use-cases, usage and adoption rises. Coupled with technical changes that make the blockchain more secure, scalable, and less volatile in terms of fees, I can see ETH prices going a lot higher in the near future.

It’s not a crypto article without a crazy price prediction.

But nobody will take sidehustlerich seriously when it comes to price, so there’s no one better than a Winklevii to give us his insights and price prediction for ETH in the near future.

Let me end this article by saying I love bitcoin, and it will have its place as one of the OG crypto that will endure the test of time, precisely because it is difficult and resistant to change.

But ETH, with it’s many use-cases, will prove to be more valuable, just because of the industries it will change.

There’s a chinese saying…

不管黑猫白猫,捉到老鼠就是好猫。

– 邓小平 (Deng xiaoping)

That translates to: “it doesn’t matter if you’re a black cat or a white cat. A good cat is a cat that catches the mouse.”

In my opinion, both BTC and ETH are good cats.

ETH is growth, BTC is value. As long cryptos don’t implode.

BTC may evolve to be more like gold, with intrinsic value & price floor. And just like gold, BTC in the future can go through decades of underperformance or outperformance.

ETH may be the rocket for the next few years, but whether it will suffer the fate of internet pioneers like Yahoo, Netscape, Alta Vista, AOL remains to be seen. Or go to Mars like Microsoft & Amazon & Google.

Agree. Both look very good in the near term of 3 to 5 years.