Savings is not enough? We work hard for 9 hours a day, saving 10 to 20% of our income, and plan to work till we’re 65, and yet, in the back of our minds, we still question if it is enough (it’s not) and we still need to go out the risk curve and try to get more yield on our savings via investments.

Why?

Because inflation? What is inflation?

We see inflation as the price of goods and services going up. But why do goods and services go up every year without fail?

That yakun toast set doesn’t get better year on year. Why do we need to pay more?

Those eggs aren’t laid by progressively intelligent chickens. So why do eggs cost more each year? In fact, why does literally EVERYTHING go up in price every year?

Is there something wrong with our money?

Aaah.. finally we’re getting closer to the real issue at hand.

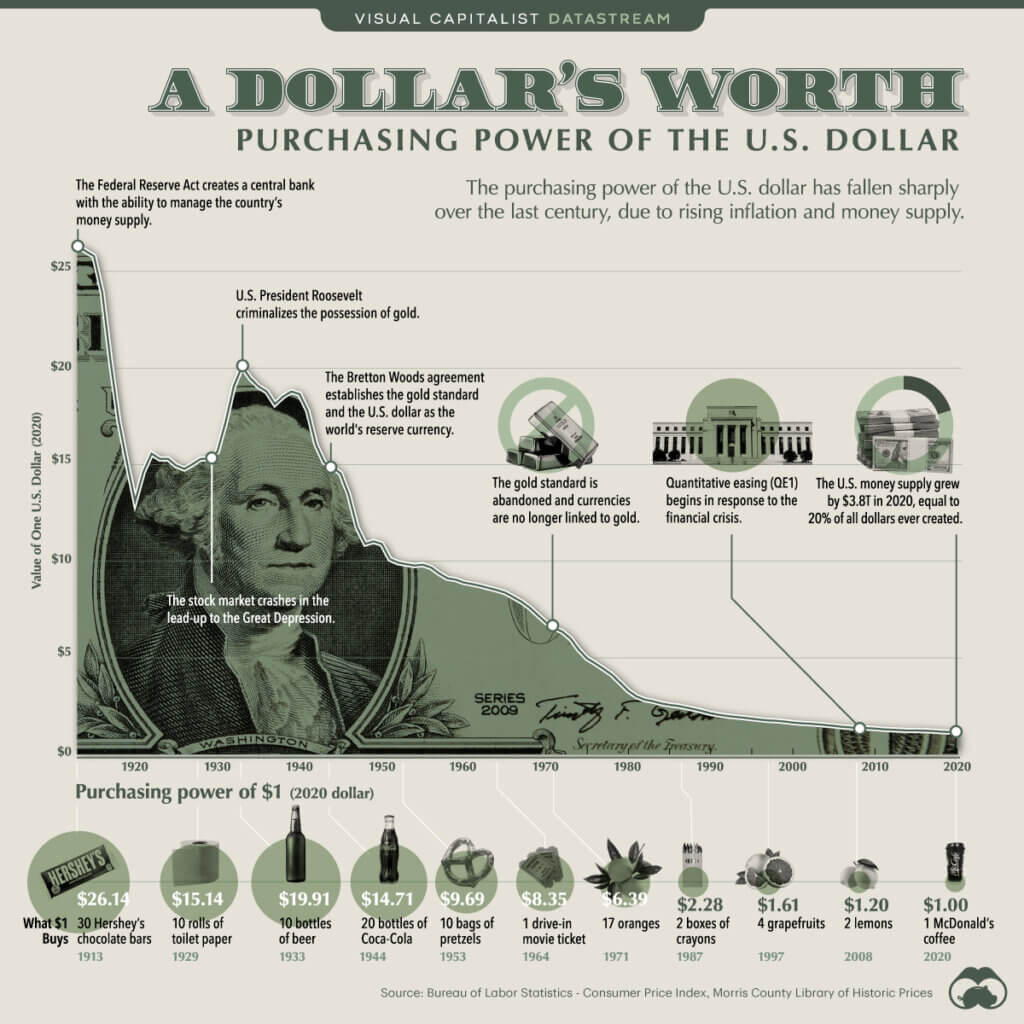

I’m sure you have all seen variations of this chart. Is the price of everything actually going up, or is the purchasing power of the dollar going down? Did you know that since 1971, the US abolished the gold standard, and the US dollar, since then was no longer backed by physical gold?

When the price of everything goes up, the only logical conclusion should not be that everything is getting better. The only logical conclusion I can draw from this, is that the value of our money is getting shittier.

We bought our first home, a HDB flat in Tampines in 2007 for $371,000. We sold it in 2016, for $700,000.

If I had $371,000 in the bank in 2007. Assuming I’m an idiot who doesn’t know how to make use of a high yield savings account… at an interest rate of 0.05% p.a., I will have a total of $372,859.

So there you have it. Our fiat currency is shit at retaining purchasing power. Every year, the amount of things we can buy with the same dollar amount drops. This is why we’re pushed to invest every dollar, park it in appreciating assets so that the value of our money can catch up with the debasement of the currency.

US currency debasement and de-dollarization efforts by BRICS

The US national debt recently crossed $35 Trillion dollars. That is such an insane number. Just servicing the interest on the debt alone, is an astonishing $2.4B, per day!

What else can the government do, but print more money to pay down the debt? And herein lies the conundrum. Print more money, debase the currency more, higher inflation kicks in, resulting in the need to print more money to support the economy.

This, plus the effort by the BRICS nations to ramp up de-dollarisation efforts, will lead to the US dollar devaluing at an even higher rate, until potentially we get into a hyperinflation scenario.

This is where we invest in assets

Alright, by now, I think we’ve established that the dollar, not just the US dollar, but almost any fiat currency, faces a reduction in purchasing power over time. That is a given.

So, what can we do about it? Well, firstly, let’s not put too much savings in the bank, since that’s going to be a losing venture, guaranteed. With the fed announcing rate cuts in September of 50 basis points, we’re looking at bank deposit rates following suit, which means our money in the bank will be devaluing at an even higher rate.

Equities, real estate historically outperform inflation. And now, an emerging asset that is provably scarce, is getting mainstreamed by the day. Yes, I’m talking about Bitcoin.

Bitcoin, an emerging asset class and a store of value

Bitcoin is still considered young as an asset class, but it has been the best performing asset bar none, over the last decade.

It is currently just over a Trillion in market cap, but many in the industry are saying it can potentially eclipse gold’s market cap over the next few years.

BlackRock, VanEck and other institutions have also launched spot Bitcoin ETFs, which have promptly gone on to become the fastest growing ETF, ever.

Bitcoin is gaining traction. Fast.

Better hop on, because now, the risk is not in buying bitcoin, but in NOT having any exposure to bitcoin when it, as they say, go to the moon.

And if you’re buying bitcoin, remember, not your keys, not your coin. Consider getting a hardware wallet like a Ledger Stax to keep your coin safe.